Accrual-based accounting is a popular method for big companies, as it uses the double-entry accounting method, which is more accurate and conforms with the generally accepted accounting principles (GAAP). Imagine your small furniture company delivers a full bedroom set worth $6,000 to a client on March 1st, but you set the invoice due date as April 15th. Using the accrual method, you would record the $6,000 for services rendered as revenue right away, regardless of when the client pays the bill. You may also use this method for revenue and expenses received or paid before providing or receiving the service (deferral).

Why is the accrual basis of accounting generally preferred over the cash basis?

He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

More Time and Cost

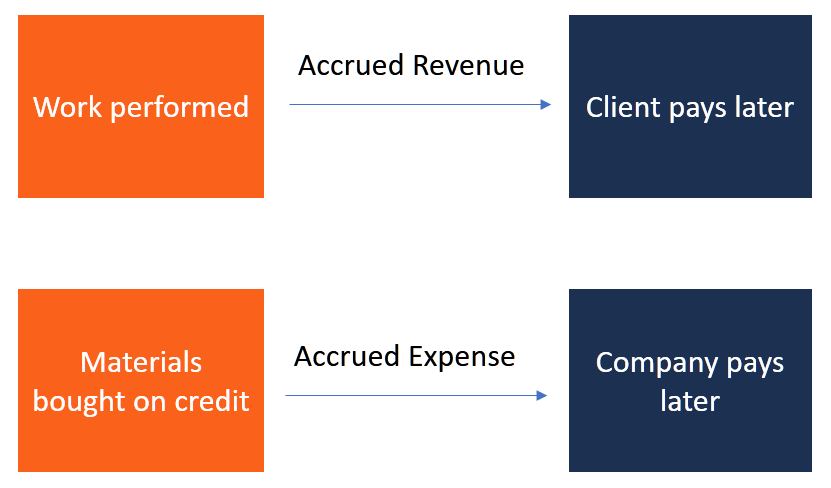

This means that revenue is only recorded when payment is received, and expenses are only recorded when payment is made. This method is simpler and easier to use, making it popular among small businesses and individuals. The revenues a company has not yet received payment for and expenses companies have not yet paid are called accruals. Here are the four types of accruals typically recorded on the balance sheet when following the accrual accounting method. Revenue accruals represent income or assets (including non-cash-based ones) yet to be received.

- So, company XYZ receives the current utility bills on the 23rd of the following month and not before.

- Because the utility companies do not bill their customers for the current month but for the next month, the accountant pays the utility bills of January in February and of February in March and so on.

- Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

- If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice.

- Accrual accounting gives a far better picture of a company’s financial situation than cost accounting because it records not only the company’s current finances but also future transactions.

Prepaid Expenses

In conclusion, understanding accruals is essential for navigating the complex world of financial markets. Accrual accounting provides a more accurate representation of a company’s financial position by recognizing revenues and expenses when they are incurred, rather than when cash is exchanged. At the end of the accounting period, the company has completed a project for a client but has not yet received payment. The consulting fees earned are considered accrued expenses until the client settles the invoice. Even though the company has not received the cash, it recognizes the revenue and records the corresponding expense as an accrued expense.

The purpose of accruals is to ensure that a company’s financial statements accurately reflect its true financial position. This is important because financial statements are used by a wide range of stakeholders to evaluate the financial health and performance of a company including investors, creditors, and regulators. An accrual is a record of revenue or expenses that have been earned or incurred but haven’t yet been recorded in the company’s financial statements. This can include things like unpaid invoices for services provided or expenses that have been incurred but not yet paid.

Accruals play a crucial role in ensuring accurate financial reporting in the world of finance. This method allows businesses to reflect their true financial position and performance, providing investors, creditors, and other stakeholders with a more reliable snapshot of the company’s operations. Understanding accrual accounting is essential for anyone involved in financial management. Accrual accounting is based on the accrual method, which is the opposite of the cash basis method of accounting.

Revenue accruals happen when goods or services have been rendered, but no payment has been received yet. They are considered to be receivable accounts on the balance sheet, and are recorded accruals definition as such. Companies like consulting services are normally held on retainer, and paid per accounting period. Consulting companies will list their services and costs as revenue accruals.

Accrual accounting recognizes revenues when they are earned, even if the cash for those revenues has not been received yet. Similarly, expenses are recorded when they are incurred, irrespective of when the cash is actually paid. This approach allows for a more accurate representation of a company’s financial position, as it aligns with the matching principle of generally accepted accounting principles (GAAP). Accrual accounting and cash basis accounting differ in how they record transactions. While cash basis accounting records transactions when cash is received or paid, accrual accounting records transactions when they occur, regardless of when cash is received or paid.