This includes everything from major fraud and theft to accounting miscalculations, insufficient funds, and incomplete or duplicated payments. An NSF (not sufficient funds) check is a check that has not been honored by the bank due to insufficient funds in the entity’s bank accounts. This means that the check amount has not been deposited in your bank account and hence needs to be deducted from your cash account records. Compare the business’s financial records to the bank statement to spot the errors.

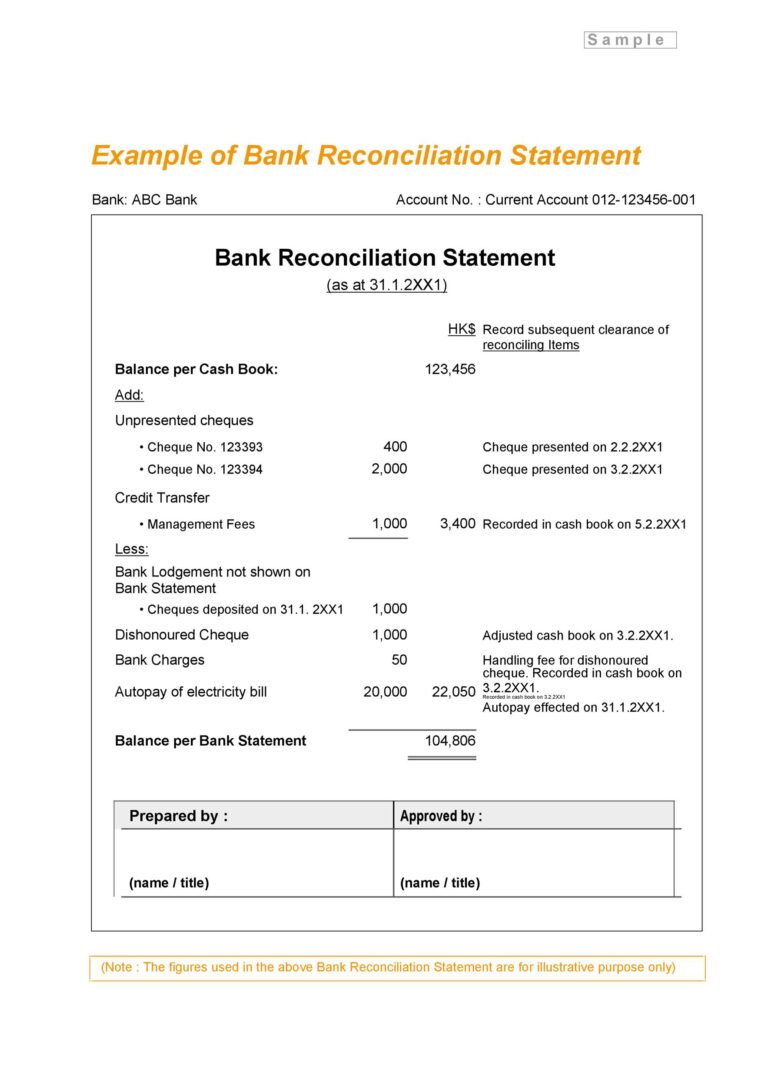

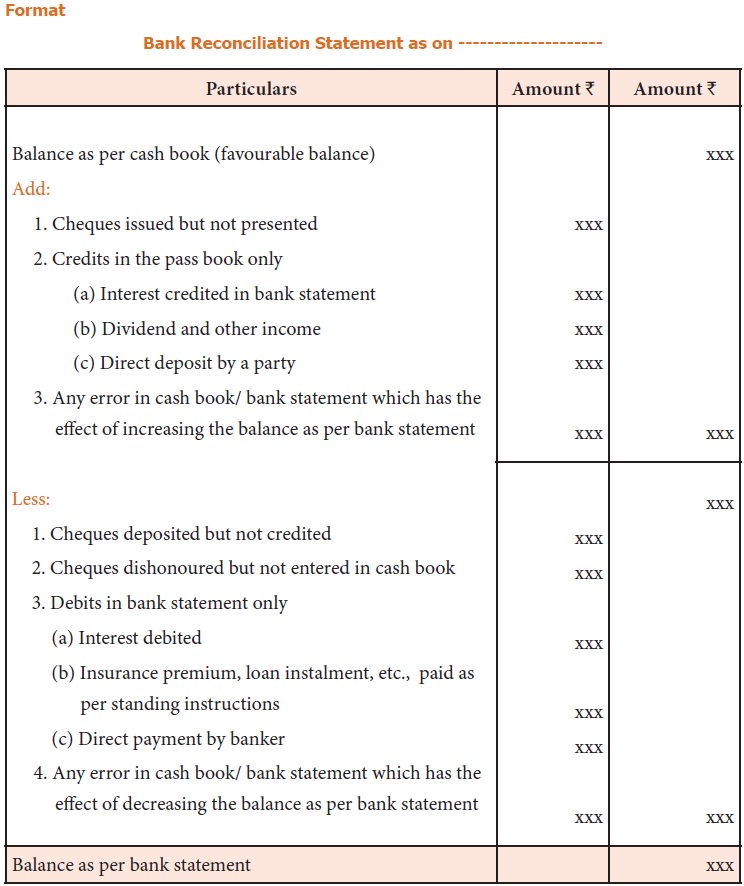

Adjusting the Bank Statement Balance

To do this, businesses need to take into account bank charges, NSF checks, and errors in accounting. Once the balances are equal, businesses need to prepare journal entries to adjust the balance per books. Deposits in transit are amounts that are received and recorded by the business but are not yet recorded by the bank.

Step 5: Record All Adjustments As Per Cash Book Into Your Company’s General Ledger Cash Account

Automating bank reconciliation can bring numerous benefits to a business, including increased accuracy, productivity, and cost savings. By using software tools to automate bank reconciliation, businesses can focus on other critical tasks and make informed business decisions based on accurate financial data. Recording transactions on the general ledger or subledger as soon as they occur helps reduce errors and makes the reconciliation process more manageable. Using the source record of every transaction at the time of reconciliation, will give the most accurate results. One is making a note in your cash book (faster to do, but less detailed), and the other is to prepare a bank reconciliation statement (takes longer, but more detailed).

Deductions from a bank statement:

The bank statement and the company’s records now both show a $6,975 balance. Starting with an incorrect opening balance can lead to errors in the reconciliation process. It’s essential to ensure preparing a bank reconciliation that the starting balance is accurate before beginning the reconciliation process. 10% of all occupational fraud cases in small businesses are due to bank account reconciliation errors.

Review: What are bank reconciliations?

This can range from one-off errors such as calculation mistakes or double payments to major concerns like theft and fraud. While reconciling your books of accounts with the bank statements at the end of the accounting period, you might observe certain differences between bank statements and ledger accounts. If this occurs, you simply need to make a note indicating the reasons for the discrepancy between your bank statement and cash book.

- Add back any receipts for deposits in transit from a company to the bank, which have been paid in but not yet processed by the bank.

- After adjusting all the above items, you’ll end up with the adjusted balance as per the cash book, which must match the balance as per the passbook.

- Adjust your records to match the bank statement, considering deposits, withdrawals, fees, and errors.

- If your company receives bank statements more frequently, for example, every week, you may also choose to do a bank reconciliation for every statement you receive.

- Some bank services, including expedited payments, bank drafts, and in some cases paper bank statements, may come with additional bank fees.

- Using the source record of every transaction at the time of reconciliation, will give the most accurate results.

Bank reconciliation isn’t just important for maintaining accurate business finances—it also ensures your customer and business relationships remain strong. Regular bank reconciliation double-checks that all payments have been accurately processed. This includes payments by customers to your company and payments from your company to employees, contractors, and other goods and services providers.

How you choose to perform a bank reconciliation depends on how you track your money. Some people rely on accounting software or mobile apps to track financial transactions and reconcile banking activity. Others use a paper checkbook, and balance it each month, to keep a record of any written checks and other transactions. You can also opt to use a simple notebook or spreadsheet for recording your transactions. The final balance on the bank reconciliation statement, after all corrections and adjustments, is the actual “true” cash balance reported in the company’s balance sheet.

Reconciling your bank statements won’t stop fraud, but it will let you know when it’s happened. In huge companies with full-time accountants, there’s always someone checking to make sure every number checks out, and that the books match reality. In a small business, that responsibility usually falls to the owner (or a bookkeeper, if you hire one. If you don’t have a bookkeeper, check out Bench). After including all the amounts identified in Step 3, your statements should display the same final balance. If any discrepancies cannot be identified and reconciled, it may signal an error or risk of fraud which your company can investigate further.